Unlocking Financial Opportunities for Your Business with Superkredyty

The world of business finance can often be complex and daunting. Every entrepreneur aims for business success, but achieving that success requires access to quality resources, expert advice, and reliable financing options. This is where Superkredyty comes into play. By leveraging financial services offered by banks and credit unions, alongside comprehensive financial advising, Superkredyty provides the tools necessary for significant business growth.

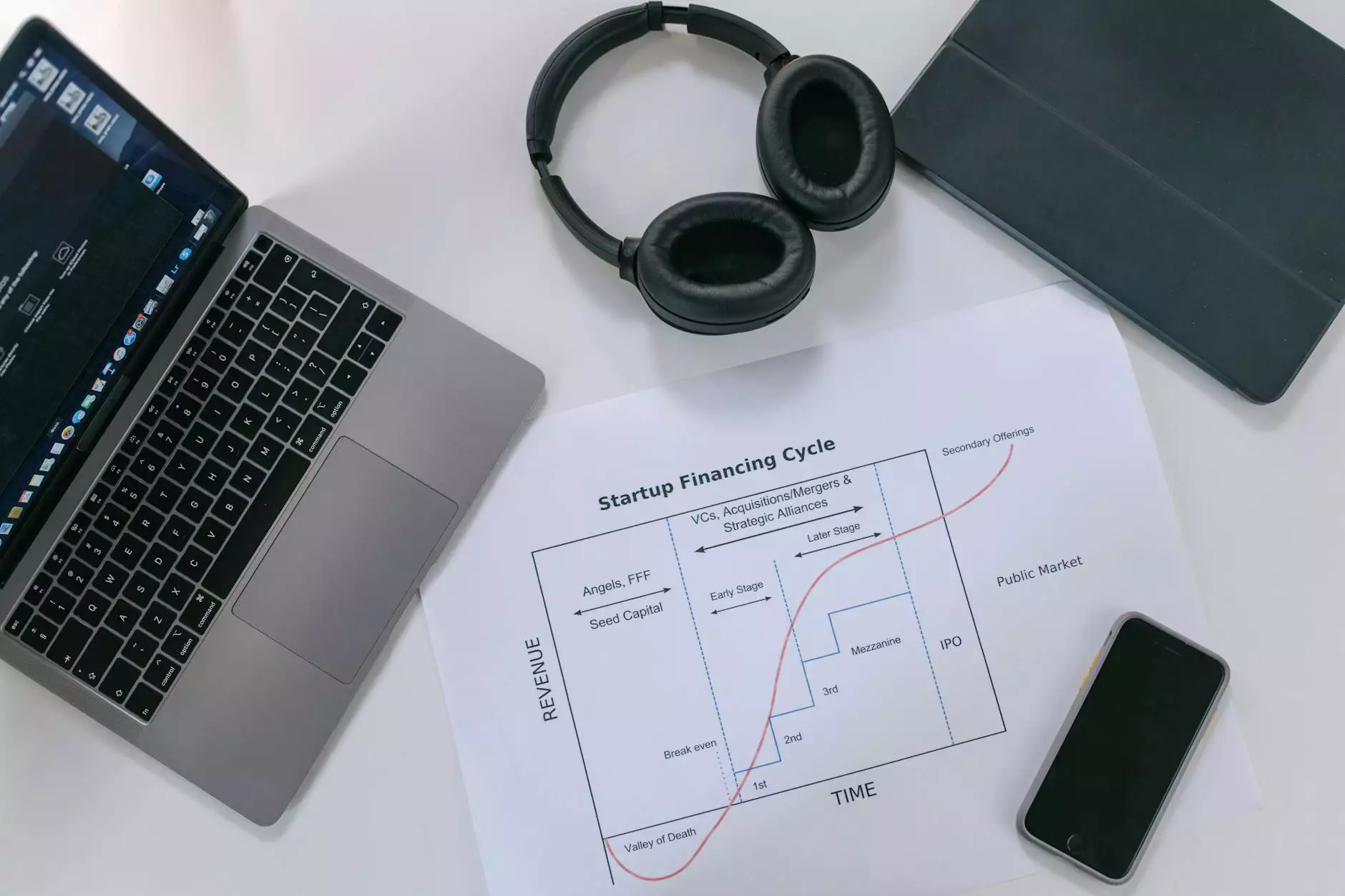

Understanding the Landscape of Business Financing

Before diving into the specifics of how Superkredyty can assist your business, it's essential to understand the various categories of business financing available today. We can break these down into several key areas:

- Banks & Credit Unions: These traditional financial institutions offer a variety of products that can cater to businesses of all sizes.

- Financial Advising: Professional insight into managing finances, investments, and overall business growth.

- Business Financing: Different types of loans and funding opportunities aimed at assisting businesses in their operational needs.

The Role of Banks & Credit Unions in Business Growth

Banks and credit unions are foundational to the business financing ecosystem. They offer a spectrum of services that can aid a company in stabilizing and growing its operations.

Benefits of Working with Banks and Credit Unions:

- Access to Capital: Businesses often need loans to scale their operations. Banks and credit unions provide varying types of loans, including lines of credit, term loans, and equipment financing.

- Competitive Interest Rates: Many banks and credit unions offer lower interest rates compared to alternative lenders, making it more affordable for businesses to borrow.

- Flexibility in Terms: These institutions often have customizable loan terms, which can be tailored to meet specific business needs.

Choosing the Right Financial Institution

Choosing the right bank or credit union is pivotal. Entrepreneurs should consider factors such as location, customer service, services offered, and the institution's reputation within the community. Working with an institution that understands your sector can significantly impact your success.

The Importance of Expert Financial Advising

Even the most promising businesses can struggle without effective financial management. Here’s where financial advising plays a crucial role.

What Can Financial Advisors Do for Your Business?

- Risk Management: Advisors can help identify potential financial risks that could affect your business and provide strategies to mitigate them.

- Investment Insights: With their expertise, financial advisors guide business owners on where to invest for maximum returns.

- Strategic Planning: Advisors assist in crafting a financial strategy that aligns with your business goals, ensuring that all financing decisions drive toward that vision.

Comprehensive Business Financing Solutions

Superkredyty stands out as a leader in the business financing arena, offering various solutions tailored to meet the unique needs of businesses.

Types of Financing Available

Here are some of the primary financing solutions that Superkredyty provides:

- Startup Loans: Designed for new businesses looking to get off the ground with sufficient capital.

- Expansion Loans: These loans help established businesses grow, whether through opening new locations or increasing product offerings.

- Equipment Financing: Businesses can finance the purchase of necessary equipment without draining their cash reserves.

- Working Capital Loans: These funds assist in covering daily operational costs, ensuring smooth business operations.

Why Choose Superkredyty for Your Business Financing?

When it comes to making financial decisions, choosing the right partner can make all the difference. Here’s why Superkredyty is an excellent choice for your financing needs:

- Tailored Solutions: Every business is different. Superkredyty takes the time to understand your unique business model and offers financing solutions that align with your needs.

- Expert Guidance: With a team of experienced financial advisors, Superkredyty provides insights that empower businesses to make informed financial decisions.

- Streamlined Processes: The application and funding processes are designed to be as straightforward as possible, allowing you to access funds quickly and efficiently.

- Transparent Terms: All financing options come with clear terms and conditions, ensuring that you are fully aware of your obligations.

Success Stories: Businesses Thriving with Superkredyty

Many businesses have achieved significant growth and success by partnering with Superkredyty. Here are a few success stories:

Case Study 1: Tech Start-Up

A tech start-up required essential funding to launch its flagship product. By working with Superkredyty, they received a startup loan that not only provided the necessary capital but also included strategic financial advice. Within a year, they expanded their team and increased their market share by 30%.

Case Study 2: Local Restaurant

A local restaurant sought to expand its operations by opening a second location. Superkredyty provided an expansion loan along with insights into managing increased operational costs. The restaurant exceeded its revenue projections in the first six months of operation.

Case Study 3: E-commerce Business

An e-commerce business required funding for new equipment to enhance production efficiency. With Superkredyty’s equipment financing, they could invest in state-of-the-art machinery, leading to a 40% increase in production and significantly reduced turnaround times.

How to Get Started with Superkredyty

If you’re ready to take the next step towards financing your business, getting started with Superkredyty is simple:

- Visit the Website: Go to Superkredyty's homepage to explore the financing options available.

- Contact a Financial Advisor: Speak to an expert to discuss your business needs.

- Submit an Application: Fill out the necessary application forms to initiate the financing process.

- Receive Funding: Upon approval, receive your funds and start using them to grow your business.

Achieve Greater Heights with Superkredyty

In conclusion, the journey toward business success is paved with robust financial decisions and strategic advice. Superkredyty stands as a pillar of support in navigating these waters. By leveraging their comprehensive services, including banking solutions, financial advising, and tailored business financing, you can unlock your business's full potential.

Whether you are just starting or looking to expand, the resources and expertise that Superkredyty offers can propel your business from good to great. Start your journey towards financial empowerment today!

https://superkredyty.com