The Power of 'Tagatisega Laenud' for Real Estate and Financial Services

Introduction

In the dynamic world of Real Estate and Financial Services, the concept of tagatisega laenud holds significant importance. For businesses looking to expand, individuals seeking financial solutions, or investors venturing into property acquisitions, understanding the essence of tagatisega laenud is crucial.

Exploring 'Tagatisega Laenud'

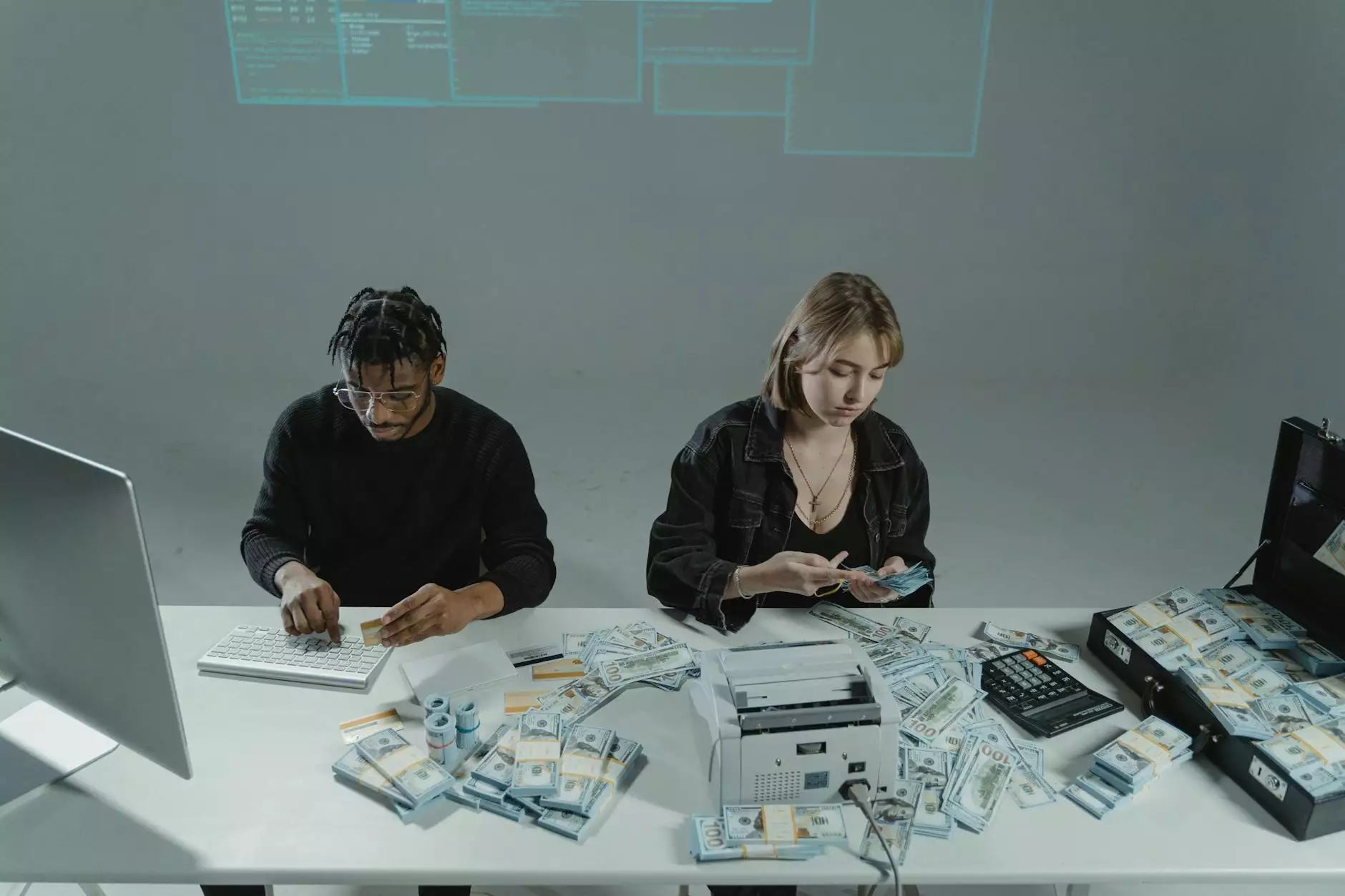

Tagatisega laenud, also known as secured loans, are financial instruments that require collateral to secure the borrowed amount. The collateral, which can be in the form of real estate or other valuable assets, provides a sense of security for both the lender and the borrower.

Benefits of 'Tagatisega Laenud'

One of the key advantages of tagatisega laenud is the ability to access larger loan amounts compared to unsecured loans. Lenders are more willing to provide substantial funds when backed by collateral, making it an ideal solution for high-value transactions in the Real Estate sector.

Moreover, secured loans often come with lower interest rates, reducing the overall cost of borrowing for individuals and businesses alike. This cost-efficient approach makes tagatisega laenud an attractive option for those looking to optimize their financial strategies.

Real Estate Expansion with 'Tagatisega Laenud'

For Real Estate developers and investors, tagatisega laenud play a pivotal role in facilitating property acquisitions, development projects, and renovation endeavors. By leveraging the collateral-backed financing, businesses can capitalize on market opportunities and propel their growth ambitions.

Unlocking Financial Services Potential

Financial institutions offering tagatisega laenud cater to a diverse range of clients, including individuals in need of short-term liquidity solutions or long-term investment funding. These secured loans serve as a bridge between financial goals and tangible assets, enabling clients to realize their aspirations with confidence.

Maximizing Returns Through Title Loans

Another aspect of tagatisega laenud in the Financial Services sector is the utilization of title loans. Title loans use the borrower's vehicle title as collateral, allowing individuals to access quick cash while retaining the use of their vehicles. This unique financial tool offers flexibility and convenience to those facing urgent financial needs.

Empowering Financial Choices

By incorporating tagatisega laenud in their service offerings, Financial Services providers empower clients to make informed decisions based on their specific requirements. Whether it's securing a loan for a real estate endeavor or using a title loan for immediate cash flow, the availability of secured financing options enhances financial freedom and flexibility.

Conclusion

As the landscape of Real Estate and Financial Services continues to evolve, the role of tagatisega laenud remains paramount in enabling growth, mitigating risks, and fostering financial prosperity. By embracing secured lending solutions, businesses and individuals can navigate the complex terrain of finance with confidence and clarity.

Explore the possibilities of 'tagatisega laenud' with Reinvest - your trusted partner in Real Estate and Financial Services.